Sustainability Report | TransUnion Flipbook

2021 Sustainability Report | 57 pages

2021 Sustainability Report

© 2022 Trans Union LLC. All Rights Reserved. No part of this publication may be reproduced or distributed in any form or by any means, electronic or otherwise, now known or hereafter developed, including, but not limited to, the Internet, without the express written permission of TransUnion. This document is protected by US and International copyright laws. This document and the subject matter contained herein is TransUnion proprietary information, and may not be shared or used for any purposes other than the purpose for which it was provided by TransUnion, without the express written permission of TransUnion. Requests for permission to reproduce or distribute any part of, or all of, this publication should be mailed to: Legal Department TransUnion 555 West Adams Chicago, Illinois 60661 The “TransUnion” logo, TransUnion, and other trademarks, service marks, and logos (the “Trademarks”) used in this publication are registered or unregistered Trademarks of Trans Union LLC or their respective owners. Trademarks may not be used for any purpose whatsoever without the express written permission of the Trademark owner. www.transunion.com TRANSUNION | 2021 SUSTAINABILITY REPORT 2

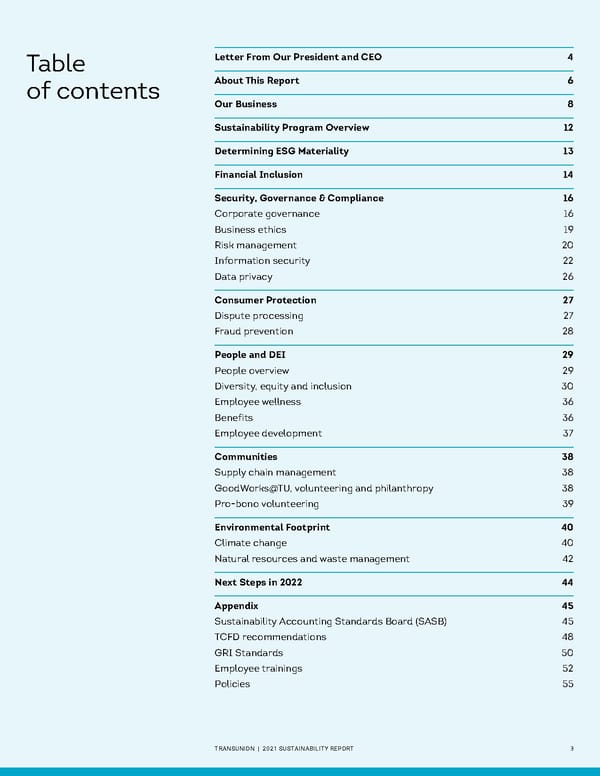

Table Letter From Our President and CEO 4 of contents About This Report 6 Our Business 8 Sustainability Program Overview 12 Determining ESG Materiality 13 Financial Inclusion 14 Security, Governance & Compliance 16 Corporate governance 16 Business ethics 19 Risk management 20 Information security 22 Data privacy 26 Consumer Protection 27 Dispute processing 27 Fraud prevention 28 People and DEI 29 People overview 29 Diversity, equity and inclusion 30 Employee wellness 36 Benefits 36 Employee development 37 Communities 38 Supply chain management 38 GoodWorks@TU, volunteering and philanthropy 38 Pro-bono volunteering 39 Environmental Footprint 40 Climate change 40 Natural resources and waste management 42 Next Steps in 2022 44 Appendix 45 Sustainability Accounting Standards Board (SASB) 45 TCFD recommendations 48 GRI Standards 50 Employee trainings 52 Policies 55 TRANSUNION | 2021 SUSTAINABILITY REPORT 3

Letter From At TransUnion, we believe knowledge is powerful. The insights and understanding our products provide enable people to access better opportunities. As the world grappled with Our President complex issues of economic relief, racial equity and climate action, we focused on creating products and programs that would be part of the solution. As a result, we advanced financial inclusion, supported our associates, limited our environmental impact, and created strong and CEO revenue along the way. In this report, we discuss the key touchpoints between society and our business, as well as the solutions we are bringing to the fore. In early 2022, we watched with a heavy heart the situation in Ukraine. In March, we donated $100,000 to the International Committee of the Red Cross to provide emergency assistance in Ukraine, including food, essential supplies and medical items. We also pledged to match up to another $100,000 that will be donated to the American, British, Canadian and Lithuanian Red Cross societies’ relief programs in response to this crisis, through an employee gift matching program. We believe everyone should have access to a peaceful and prosperous life regardless of where they are. I detail below the other ways in which we contributed to creating a better world for all. Advancing inclusion Our business, at its core, is grounded in increasing financial inclusion and economic opportunity. Before there were nationwide credit reporting agencies, individuals had limited access to credit except through their own networks — a construct that disadvantaged traditionally underrepresented communities in the financial system. In the United States alone, we understand 60 million people are credit disadvantaged. Beyond the United States, many more individuals internationally struggle to get access to credit and opportunities. TransUnion leverages data to reduce the obstacles individuals face in accessing credit for everyday moments, such as buying groceries, as well as major life events, like purchasing a home for the first time. As a pioneer in alternative credit data use, we help underbanked and underrepresented individuals gain access to mainstream financial products — even if they have not been users of traditional credit. Alternative data sets include utility and cell phone bills, as well as rental payment history. You can read more about TransUnion’s focus on financial inclusion in its new dedicated section. Safeguarding data The pandemic accelerated the pace of digitalization, as a range of services, jobs and interactions increasingly became virtual. With more of our lives available online, consumers, companies, and governments continue to face cybercriminals seeking to misuse consumer information. TransUnion, like many other companies tied to the financial sector, is the subject of interest for cybercriminals seeking to do harm. We maintain a Global Information Security program to prevent malfeasance in alignment with industry best practices and standards. TransUnion also regularly invests in updating its technology and tools as cybercriminals increase in sophistication. Lastly, we ensure everyone at our company is keeping data assets safe with regular trainings, educational resources, phishing exercises and policy attestations. You can read more about our Global Information Security program and practices here. TRANSUNION | 2021 SUSTAINABILITY REPORT 4

Reimagining work Providing increased work flexibility is critical to remaining competitive at a time when the demand for skilled professionals has never been higher. The COVID-19 pandemic offered us a chance to reimagine the way we work together. Over the last two years, we discovered we are united by a common sense of purpose rather than a location or an office. At TransUnion, we are fostering an environment of belonging and flexibility that supports associates in bringing their authentic selves to work while supporting their lives at home. Despite most of our workforce remaining remote today, we are redesigning our collaboration processes to enable post- pandemic hybrid and in-person work arrangements, in addition to fully remote options. We also expanded mental health benefits to all our associates and their families. We see mental health, work-life balance and wellness as fundamental parts of our culture. A supportive culture is necessary to do right by our associates and enable exceptional performance. In addition, we supported our associates’ abilities to bring their whole selves to work through our Diversity, Equity & Inclusion (DEI) efforts. In 2021, we increased DEI engagement by expanding unconscious bias training to all associates, enabling DEI roundtable conversations between associates and leaders, and offering tailored mentorship and development opportunities for associates from underrepresented communities, and much more. Addressing climate change We believe every sector of society must do its part to protect the planet, and in 2021, we focused our sustainability program on setting aspirational yet attainable climate goals. First, we established baseline metrics for our greenhouse gas emissions. But we didn’t stop there: We also launched scope 1, 2 and 3 climate change goals for the first time — pledging net-zero for scope 1 and 2 emissions by 2025, and at least a 30% reduction on leased real estate scope 3 emissions by 2030. You can read more about our position on climate change in our Appendix for recommendations from the Task Force on Climate-Related Financial Disclosures. Looking forward While we are proud of our 2021 sustainability advancements, we know there is more work to be done and we will continue to push for progress. In 2022, TransUnion will expand our financial inclusion footprint; key among our objectives is the launch of a new fairness framework to assess our products for disparate impact. Additionally, we will continue our environmental efforts, starting the process of identifying new renewable energy opportunities for our organization, and offsetting our emissions while also making meaningful advancements. Lastly, we will continue expanding our reporting on sustainability topics as we seek to fully align with the recommendations from the Task Force on Climate-Related Financial Disclosures. As we celebrate our continued progress, we look forward to expanding our contributions to create a more equitable society and healthy planet. Sincerely, Chris Cartwright | President and Chief Executive Officer TRANSUNION | 2021 SUSTAINABILITY REPORT 5

About this TransUnion’s 2021 Sustainability Report was published on April 14, 2022 and reflects activities and initiatives in our fiscal year 2021 (January 1, 2021–December 31, 2021), Report as well as certain planned events in 2022. To allow for comparability, we have included information on our ESG performance for four methodologies: SASB, TCFD, UN SDGs, and GRI. Glossary ESG Environmental, social and governance issues DEI Diversity, Equity and Inclusion SASB Sustainability Accounting Standards Board TCFD Task Force on Climate-Related Financial Disclosures UN SDGs United Nations Sustainable Development Goals GRI Global Reporting Initiative Materiality We are reporting on our most material topics identified during our 2021 materiality assessment. For purposes of this report, the issues identified in the ESG materiality section could differ with the definitions used for filings with the Securities and Exchange Commission (SEC). Issues deemed material for purposes of this report may not be considered material for SEC reporting purposes. ABOUT THIS REPORT TRANSUNION | 2021 SUSTAINABILITY REPORT 6

Forward-looking statements This report contains forward-looking statements which are based on our current assumptions and expectations. Any statements made in this report that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements. These statements often include words, such as “anticipate,” “expect,” “guidance,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast,” “outlook,” “potential,” “continues,” “seeks,” “predicts,” or the negatives of these words and other similar expressions. The principal, forward-looking statements in this report include (1) our goals, commitments and programs; (2) our business plans, initiatives and objectives; (3) our assumptions and expectations; (4) the scope and impact of our corporate responsibility risks and opportunities; and (5) standards and expectations of third parties. All such forward-looking statements are intended to enjoy the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Actual results may differ materially from those described in the forward-looking statements. The most important factors that could cause our actual results to differ from our forward- looking statements are set forth in our description of risk factors included in Part I, Item 1A, Risk Factors of our Form 10-K for the fiscal year ended December 31, 2021 — which should be read in conjunction with the forward-looking statements in this report. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement. Acquisitions In December 2021, we completed the acquisition of two companies, Neustar and Sontiq, which we anticipate will significantly enhance our offerings. Neustar, a premier identity resolution company with leading solutions in Marketing, Fraud and Communications, enables customers to build connected consumer experiences by combining decision analytics with real-time identity resolution services driven by its OneID™ platform. Sontiq provides solutions, including identity monitoring, restoration, and response products and services, to empower consumers and businesses to proactively protect against identity theft and cyber threats. We will incorporate the impact of these acquisitions in our 2022 Sustainability Report, but their impact is not reflected herein unless expressly specified. In addition, TransUnion completed a divestiture of its Healthcare business on December 17, 2021; the metrics reported herein reflect the divesture. ABOUT THIS REPORT TRANSUNION | 2021 SUSTAINABILITY REPORT 7

Our Business TransUnion is a leading global information and insights company that makes trust possible between businesses and consumers, working to help people around the world access opportunities that can lead to a higher quality of life. That trust is built on TransUnion’s ability to deliver innovative solutions with credibility and consistency. We call this Information for Good®. Grounded in our heritage as a credit reporting agency, we have built robust and actionable databases of information for a large portion of the adult population in the markets we serve. We use our data fusion methodology to link and match an increasing set of disparate data to further enrich our database. We use this enriched data, combined with our expertise, to continuously develop more insightful solutions for our customers, all in accordance with global laws and regulations. Because of our work, organizations can better understand consumers in order to make more informed decisions, and earn consumer trust through personalized experiences and the proactive extension of the right opportunities, tools and offers. In turn, we believe consumers can be confident their data identities will result in better offers and opportunities. We provide solutions that enable businesses to manage and measure credit risk, market to new and existing customers, verify consumer identities, mitigate fraud, and effectively manage call center operations. Businesses embed our solutions into their process workflows to deliver critical insights and enable effective actions. Consumers use our solutions to view their credit profiles and access analytical tools that help them understand and manage their personal financial information and take precautions against identity theft. We have deep domain expertise across a number of attractive industries which we also refer to as verticals, including Financial Services and Emerging Verticals that consists of Insurance, Services and Collections, Tenant and Employment, Technology, Commerce & Communications, Public Sector, Media, and other emerging verticals we serve, as well as our Neustar business. We have a global presence in over 30 countries and territories across North America, Latin America, Europe, Africa, India, and Asia Pacific. We leverage our differentiated capabilities in order to serve a global customer base across multiple geographies and industry verticals. We offer our solutions to business customers in Financial Services, Insurance and other industries, and our customer base includes many of the largest companies in the industries we serve. We sell our solutions to leading consumer lending banks, credit card issuers, alternative lenders, online-only lenders (“FinTechs”), Point of Sale (“POS”)/Buy Now Pay Later (“BNPL”) lenders, auto lenders, auto insurance carriers, cable and telecom operators, retailers, and federal, state and local government agencies. We have been successful in leveraging our brand, expertise and solutions, and have a leading presence in several high-growth international markets. Millions of consumers across the globe also use our data to help manage their personal finances and take precautions against identity theft. OUR BUSINESS TRANSUNION | 2021 SUSTAINABILITY REPORT 8

Our Global Business Impact TransUnion provides free credit reports in several countries around the world, and consumers in the regions illustrated below have taken advantage of accessing their credit information through TransUnion and our partners. Free credit reports offered Upcoming free credit reports offering (Hong Kong) 1B 30+ 60 35 consumers countries million million We aim to enable 1 billion We have a presence in more At TransUnion, we understand TransUnion’s trended credit consumers to access the credit than 30 countries and territories, alternative data has the potential data helped 35 million credit- economy by enhancing existing including the United States, Canada, to help over 60 million US credit- disadvantaged US consumers gain scoring methods and helping the Latin America, the United Kingdom, disadvantaged people gain greater greater access to credit; some of underbanked gain access to Africa, Asia Pacific and India. access to credit by supplementing them for the first time, while others mainstream lending and the traditional credit information with are able to receive additional credit modern economy. new insights that reflect broader on more affordable terms. payment behaviors. Trended credit data looks at activity over a period of time to highlight consumers demonstrating increasingly positive performance on their recent credit obligations. Alternative data supplements an individual’s credit file with non-traditional payment information, such as rental, phone or utility data. For more information on trended credit and alternative data, see our Financial inclusion chapter. OUR BUSINESS TRANSUNION | 2021 SUSTAINABILITY REPORT 9

Financial results* Adjusted Revenue ($ in millions) $2,960 $2,531 $2,469 $2,175 $1,787 $1,589 + 13% 5-yr CAGR FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY 2021 Gross Adjusted Revenue Mix 59% 23% 18% US Markets International Consumer Interactive Awards and recognitions TransUnion aims to excel in every facet of its business. The awards and recognitions below outline the drive of our exceptional employees and impact of our work. US awards Best Places to Work for LGBTQ Equality 50 Companies with the Great Workplace 2021 2021 on the Human Rights Campaign Best Benefits in Chicago 2021 by the Great Place to Work® Corporate Equality Index by Built In Chicago Institute (Mumbai) Top 25 Diversity Change Leaders UK awards India’s 25 Best Workplaces (Teedra Bernard) in 2021 Credit Information Provider in IT and IT-BPM 2021 by DiversityPlus Magazine of the Year 2021 by Great Place to Work® Institute (GCC) by The Credit Awards Colombia awards Top 50 Business Leaders of Color (Marisol Pantoja) in 2021 TM India awards Great Place to Work-Certified in 2021 by Chicago United by Great Place to Work® 50 Best Workplaces for Women 100 Best Adoption-Friendly in India in 2021 (TransUnion CIBIL) Hong Kong awards Workplaces of 2021 by Great Place to Work® Institute Recognized for three employer by Dave Thomas Foundation for Adoption excellence awards in 2021 India’s 100 Best Companies 100 Best Large Companies to Work for 2021 to Work for in Chicago 2021 by the Great Place to Work® Institute by Built In Chicago *Financial results include the Neustar and Sontiq acquisitions in the calculations since the date of acquisition and exclude the financial results of our Healthcare business in all periods. OUR BUSINESS TRANSUNION | 2021 SUSTAINABILITY REPORT 10

Strategy Given the interwoven nature of our operations with global consumer credit markets, TransUnion is in a unique position to leverage our expertise to promote sustainable practices across jurisdictions and markets, fostering business practices that will drive societal benefits. Our sustainability strategy is informed by our materiality, benchmarking and gap assessments to uncover the largest opportunities for TransUnion. Mission To help people around the world access the opportunities that lead to a higher quality of life. Strategy Increase financial Enable safe, tailored Extend our role in client inclusion and business consumer experiences workflows from point solutions opportunity through superior identity to broad, configurable platforms verification and targeting that deliver insights and enable precision effective actions Strategic Differentiated A global operating State-of-the- Top-tier talent capabilities solutions powered by model with robust art technology authoritative datasets scale and scope infrastructure Sustainability Accelerating Cultivating a global Advancing climate Creating a diverse program pillars financial inclusion governance and action through and inclusive culture, of underrepresented reporting model with a renewable energy and valuing employee well- communities focus on data security efficiency being and identities and consumer privacy Sustainability Over 60 million US Stewardship and Reduced societal costs, Expanding career value created credit-disadvantaged protection of consumer risks and communities and development consumers are able identities helps prevent impacted by climate- opportunities across to get access to credit fraudulent data use and induced natural diverse populations through alternative data access opportunities disasters and geographies and the products we offer leading to a higher quality of life Our sustainability program focuses on areas most critical to our business, as well as the topics we believe offer the greatest opportunities for differentiation from our competitors. We discuss our prioritization in more detail in our ESG Materiality Assessment section. OUR BUSINESS TRANSUNION | 2021 SUSTAINABILITY REPORT 11

Sustainability In 2021, we continued our sustainability journey; reviewing our plans, expanding the scope of our commitments, and adjusting our strategy to meet the new challenges society is facing and further align with our business. Program Program overview Overview Our sustainability programming intentionally addresses the ESG risks and opportunities most salient for information services companies like TransUnion. Our programmatic efforts naturally place a premium on our consumer protection, workforce, external impacts, and the overall resilience of our operations. In addition to the key ESG focus topics outlined above, TransUnion maintains programming and policies covering a range of other topics, along with their contributions toward the UN SDGs. ESG key topics Goals Supporting actions UN SDG Contributions Financial → Accurately score 1. Offered products to expand the market to 8.10 - Strengthen the capacity of domestic financial Inclusion and expand include underserved consumers into the institutions to encourage and expand access to ® SM financial access for credit economy (e.g., CreditVision Link ) banking, insurance and financial services for all 1+ billion people 2. Partnered with HomeFree-USA to advance 9.3 - Increase the access to financial services, Black homeownership in the United States including affordable credit, in particular in 3. Donated $400,000 to Credit Builders Alliance developing countries 4. Established a fairness framework to evaluate 10.3 - Ensure equal opportunity and reduce products and services to help advance inequalities of outcome financial inclusion (full launch in 2022) 10.5 - Improve the regulation and monitoring of Additional detail available here global financial markets and institutions Security, → Year-over-year 1. Disclosed additional detail on cybersecurity 9.5 - Enhance scientific research and upgrade the Governance and improvement practices, certifications and training technological capabilities of industrial sectors in Compliance in corporate 2. Disclosed additional detail on privacy trainings all countries sustainability 3. Began implementation of the recommendations 16.6 - Develop effective, accountable and disclosures, from the Task Force on Climate-Related Financial transparent institutions at all levels specifically focused Disclosures over a three-year period 16.10(b) - Promote and enforce non-discriminatory on cybersecurity laws and policies for sustainable development and privacy 4. Made Political Engagement Policy externally available Environmental → Eliminate scope 1. Gathered baseline greenhouse gas emissions 12.2 - By 2030, achieve the sustainable management Footprint 1 and 2 emissions information and efficient use of natural resources. by 2025 2. Set short- and medium-term climate change 12.5 - By 2030, substantially reduce waste → Reduce scope 3 real targets generation through prevention, reduction, estate emissions 3. Secured renewable energy procurement for recycling and reuse. 30% by 2030 Leeds office 13.2 - Integrate climate change measures into Additional detail available here strategies and planning. 13.3 - Improve education, awareness-raising and human and institutional capacity on climate change People → Gender parity in 1. Achieved YOY increase in underrepresented 8.3 - Promote development-oriented policies that and DEI VP+ roles by 2030 groups in management support decent job creation, entrepreneurship, → Year-over-year 2. Continued progress toward gender equity with and innovation increase in a 5% increase in representation since 2019 5.5 - Ensure women’s full and effective participation underrepresented 3. Adopted global unconscious bias training and equal opportunities for leadership at all levels of groups in manager+ decision-making roles 4. Launched diversity-focused mentorship and 10.2 - By 2030, empower and promote the social development opportunities for underrepresented and economic inclusion of all groups 5. Expanded mental health benefits to employees and families globally Additional detail available here SUSTAINABILITY PROGRAM OVERVIEW TRANSUNION | 2021 SUSTAINABILITY REPORT 12

Determining TransUnion regularly collects feedback from internal and external stakeholders to determine our ESG priorities. In 2021, we refreshed our ESG materiality assessment ESG to prioritize the ESG issues most important to our stakeholders. Materiality The assessment process started with a gap analysis and industry benchmarking, as well as a review of international sustainability frameworks and ratings, including the SASB, TCFD, GRI, UN SDGs, and frequently cited ESG ratings. We surveyed and interviewed 36 internal and external stakeholders, including employees, investors, customers, NGOs and industry experts. We leveraged the insights from these different perspectives to develop our materiality matrix. We are committed to periodically refreshing our materiality assessment to ensure our program continues to align with the quickly evolving sustainability landscape. ESG materiality matrix s Cybersecurity er Data privacy Product quality ehold & data accuracy tak Corporate S Diversity, equity governance, & inclusion ethics & Customer satisfaction compliance & relations Climate Financial inclusion to External change & empowerment Employee safety, health & well-being Talent attraction, Supporting Human & retention mportance Supply chain communities labor rights & development I management Natural resource management Importance to Internal Stakeholders First Tier Our ESG materiality assessment revealed three tiers of opportunities for our Priority topics company. First, the blue circles represent confirmed issues — such as cybersecurity, Second Tier data privacy and corporate governance — that continue to be the highest priority Significant topics areas to our stakeholders. The yellow circles represent differentiation opportunities in topics such as financial inclusion and DEI. The black circles represent topics Third Tier like supporting communities, human and labor rights, supply chain management and Relevant topics natural resource stewardship. Climate change did not fit neatly into any grouping, Outlier and while the ranking is relatively low for our industry, increasing expectations to manage and disclose climate change impacts elevates it to a significant ESG topic for TransUnion. It is important to note all issues on the ESG Materiality Matrix are relevant to the company regardless of their location on the matrix. DETERMINING ESG MATERIALITY TRANSUNION | 2021 SUSTAINABILITY REPORT 13

Financial Financial inclusion is central to TransUnion’s mission and business purpose. We help consumers access credit solutions to pursue opportunities that enable them Inclusion to achieve life goals. Through access to financial education and credit management tools, we empower consumers to take control of their narrative. We recognize, however, some consumers face unique challenges, especially in underbanked and underrepresented communities. With that in mind, TransUnion pioneered bringing trended credit data to market, and then combined it with alternative data to provide a holistic view of individuals, which in turn helps include more consumers in the financial services ecosystem. Today, we continue to lead financial inclusion efforts around the world with our products, partnerships and community engagements. Financial inclusion advancements Consumer credit management tools → CreditView® Dashboard empowers consumers with the information, insight and guidance they need to understand and protect their credit health. It provides a personalized and interactive experience to both our partners and consumers. ® → Credit Compass tool empowers consumers to set and reach their credit goals. The recommendations provided by this tool are based on the real credit experiences of millions of consumers and include specific steps for improving individual credit health. Alternative credit data solutions → TransUnion also leads the effort to include alternative financial data, or nontraditional financial payments, such as rent or utility bills, in consumers’ credit reports. Alternative financial data can help consumers who haven’t had the opportunity to make larger life purchases, such as a new home or car, start to build their credit. Social impact initiatives → TransUnion partners with a number of organizations that work to help these consumers, including HomeFree-USA, to guide more Black Americans to achieve and sustain homeownership through credit counseling and education. We also support underrepresented communities through our partnership with MoCaFi, a FinTech company helping credit-disadvantaged consumers build and manage credit by enabling them to report rental payment data to TransUnion. → We’ve also continued our work with the Credit Builders Alliance to help borrowers with poor or no credit build positive credit by providing credit reports at a discounted rate, offering scholarship funds to help onboard new members, and onboarding more members as data furnishers. → In 2020, as part of our commitment to helping consumers during the pandemic, TransUnion, Experian and Equifax began offering US consumers free weekly credit reports which continues through 2022. In 2022, TransUnion and other credit bureaus went further by eliminating some types of medical debt collection from consumer credit reports. In the United States alone, over 100 million consumers accessed their TransUnion credit data (often free of charge) through our partners and website — along with many more internationally. FINANCIAL INCLUSION TRANSUNION | 2021 SUSTAINABILITY REPORT 14

TransUnion COVID-19 resources Advocacy of policy changes Consumers continued to be impacted by → The Credit Access and Inclusion Act, sponsored by Senators Tim Scott of South Carolina COVID-19 throughout 2021, and sought to and Joe Manchin of West Virginia, encourages alternative financial data to be reported to leverage tools and hardship programs to credit reporting agencies, helping consumers establish and enhance their credit through help manage their household finances. payments they are already making. COVID-19 Essential Resources → The Building Credit Access for Veterans Act, sponsored by Senators Scott and Richard TransUnion’s webpage connects Blumenthal of Connecticut, supports our veterans, many of whom have not been able consumers to practical resources, such to build their credit through traditional means, by directing the Department of Veterans as credit counseling and lender financial Affairs to create a pilot program to consider alternative financial data in its accommodation plans. lending programs. Managing Credit Through Financial Hardship TransUnion’s managing credit blog offers TransUnion continues to evolve its financial inclusion strategy to pursue new practical tips in navigating uncertainty and opportunities to expand financial inclusion and opportunity around the world. maintaining financial health. Over 40,000 individuals accessed the blog since its launch in 2020. Consumer Pulse Surveys TransUnion conducted quarterly global Consumer Pulse Studies in 2021 to measure economic hardship during the global pandemic outbreak. Policymakers and customers used the studies to better understand consumer challenges and identify struggling segments of the population. The Game Plan TransUnion partnered with VantageScore, American Express and CNN to launch The Game Plan. This financial education series addressed topics, such as: protecting credit during crisis, understanding cash flow and managing stress during financial hardship. FINANCIAL INCLUSION TRANSUNION | 2021 SUSTAINABILITY REPORT 15

Security, Corporate governance Governance TransUnion Executive Leadership sets an ethical tone from the top and maintains rigorous governance practices to meet and exceed the highest ethical and legal & Compliance standards in the jurisdictions where we operate. Board committees TransUnion’s Board of Directors guides our management on behalf of our shareholders. Our Board members bring a diverse skillset, including experience pertaining to senior leadership; corporate governance; finance and accounting; technology, privacy and cybersecurity; organizational transformation; global business management; industry expertise; and risk management. Each Committee of TransUnion’s Board of Directors focuses on distinct areas of oversight. Nominating and Corporate Oversees sustainability strategy and performance, in addition to public → Governance Committee policy and philanthropy practices → Identifies qualified board member candidates → Develops recommendations for committee participation and leadership → Oversees board member and management performance evaluations Audit and Compliance → Reviews the soundness of our system of internal controls regarding finance, Committee accounting and information security compliance → Ensures the quality and integrity of financial statements and reporting → Monitors compliance with TransUnion policies (e.g., Code of Conduct, Related Persons Transactions Policy) and legal and regulatory requirements Compensation → Establishes and reviews the company’s overall compensation philosophy Committee → Reviews and approves CEO, executive officer and non-management director compensation → Reviews incentive and equity-based compensation plans SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 16

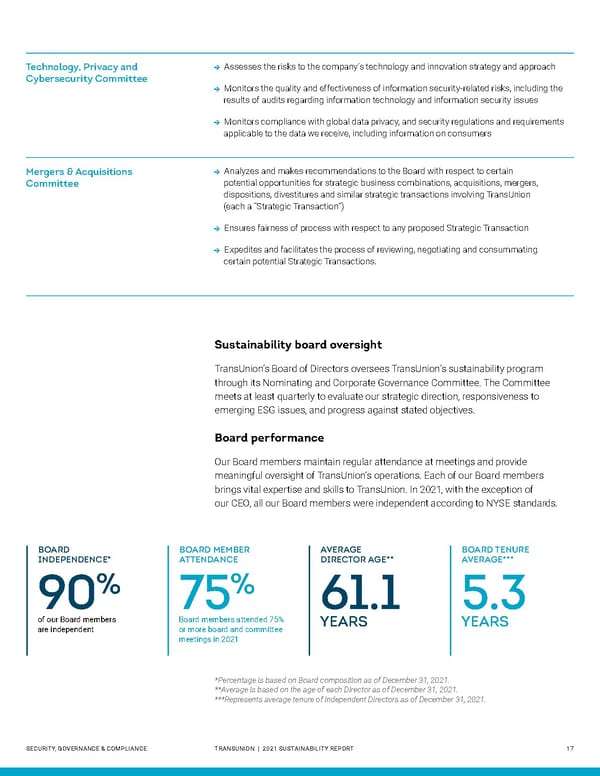

Technology, Privacy and → Assesses the risks to the company’s technology and innovation strategy and approach Cybersecurity Committee → Monitors the quality and effectiveness of information security-related risks, including the results of audits regarding information technology and information security issues → Monitors compliance with global data privacy, and security regulations and requirements applicable to the data we receive, including information on consumers Mergers & Acquisitions → Analyzes and makes recommendations to the Board with respect to certain Committee potential opportunities for strategic business combinations, acquisitions, mergers, dispositions, divestitures and similar strategic transactions involving TransUnion (each a “Strategic Transaction”) → Ensures fairness of process with respect to any proposed Strategic Transaction → Expedites and facilitates the process of reviewing, negotiating and consummating certain potential Strategic Transactions. Sustainability board oversight TransUnion’s Board of Directors oversees TransUnion’s sustainability program through its Nominating and Corporate Governance Committee. The Committee meets at least quarterly to evaluate our strategic direction, responsiveness to emerging ESG issues, and progress against stated objectives. Board performance Our Board members maintain regular attendance at meetings and provide meaningful oversight of TransUnion’s operations. Each of our Board members brings vital expertise and skills to TransUnion. In 2021, with the exception of our CEO, all our Board members were independent according to NYSE standards. BOARD BOARD MEMBER AVERAGE BOARD TENURE INDEPENDENCE* ATTENDANCE DIRECTOR AGE** AVERAGE*** % % 90 75 61.1 5.3 of our Board members Board members attended 75% YEARS YEARS are independent or more board and committee meetings in 2021 *Percentage is based on Board composition as of December 31, 2021. **Average is based on the age of each Director as of December 31, 2021. ***Represents average tenure of independent Directors as of December 31, 2021. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 17

Board diversity TransUnion benefits from having diverse representation on its Board of Directors, enabling it to better understand its various stakeholders. As of December 2021, 4 out of 10 of our directors identified with some form of gender, ethnic or racial diversity.* TransUnion is committed to maintaining a diverse Board of Directors and the Board of Directors made a firm commitment to appoint at least one ethnically or racially diverse director in 2022 as further described in TransUnion’s proxy statement. 2021 Board Diversity Profile** 10% 20% 20% 40% 90% 60% 80% 80% Independent Directors Ethnic or racially Female Directors Gender, ethnic or Executive Directors diverse Directors Male Directors racially diverse Directors Non-diverse Directors Non-diverse Directors *Board of Director demographics are reflective of fiscal year 2021. Two diverse directors resigned effective Dec. 31, 2021, which will be reflected in our 2022 Sustainability Report. **Effective February 1, 2022, the Board of Directors appointed a new director to the Board. In addition, TransUnion plans to appoint a new diverse Board member in 2022, pursuant to its commitment discussed above. Management sustainability leadership At the management level, the Executive Leadership team meets on an ad-hoc basis with TransUnion’s Sustainability Office to provide direction on strategy and execution of our enterprise ESG programming. Our Chief Sustainability Officer champions sustainability inside and out of the enterprise. TransUnion is currently reevaluating its sustainability governance structure to better integrate efforts across departments and regions. In our 2021 Proxy Statement, we disclosed for the first time our executive officers’ compensations would incorporate a diversity-focused compensation modifier into TransUnion’s annual incentive plan. The modifier reduces the named executive officers’ Strategic Individual Objectives performance achievements as a percent of target by 100 percentage points should TransUnion not meet its diversity targets***. During 2021, we achieved a year-over-year increase in both diversity measures; therefore, no modification was made to the final Strategic Individual Objectives of our named executive officers’ compensations. In 2022, we will continue our focus on DEI by having a dedicated quantitative metric equaling 5% of their target bonuses based on TransUnion’s DEI progress. ***TransUnion’s diversity targets are to increase the year-year-over representation of underrepresented minorities in director and above positions within the United States, and gender parity of females at the vice president level or above globally. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 18

Business ethics Our business ethics program permeates all our lines of business, corporate functions and operational groups. Our culture emphasizes legal and regulatory compliance, issue identification and escalation, and remediation. For us, adherence to law, accounting and ethical standards is a prerequisite to doing business and meeting stakeholder expectations. We recognize the importance of adhering to regulations and diligently accounting for the expectations of our stakeholders as part of our business strategy. Ensuring the reliability of our business and reducing reputational risk — across all dimensions — requires a steadfast commitment to ethical behavior. At TransUnion, we assert our enterprise commitment to business ethics in our Code of Business Conduct and related policies, all of which are available in the appendix of this report. Our culture emphasizes good judgment, highlighting potential areas of concern to management, and treating all TransUnion’s stakeholders in a transparent and fair manner. To accomplish this, we regularly discuss our corporate values, our ® focus on ethical behavior and what it means to use Information for Good . More concretely, all associates (including full-time and part-time) receive annual workplace ethics training and must attest to following our Code of Business Conduct and associated policies annually. We also maintain a robust Global Anti-Fraud Program comprised of an effective system of internal controls designed to prevent, detect and respond to internal fraud. The responsibility to mitigate internal fraud risk is collaboratively addressed by multiple stakeholders across our business — which includes identifying relevant internal fraud schemes, using standardized tools and trainings, partnering with pertinent departments, surveying the operating environment, documenting the mitigation measures, and developing plans to improve these measures. Reporting ethics issues ® Through our SpeakUp program, TransUnion associates are encouraged to report potential ethical issues through a variety of channels, including directly to their respective managers, a Code of Business Conduct Officer, or any member of the legal, compliance or human resources teams. TransUnion also maintains an ethics hotline for associates, affiliated partners and the general public to report (in a secure and anonymous manner) any suspected illegal, unethical or unsafe business conduct. Once an individual reports a concern through the hotline, the complaint is forwarded to the appropriate internal group to review and address. Regardless of the method used, associates who report an issue are protected from retaliation in any form. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 19

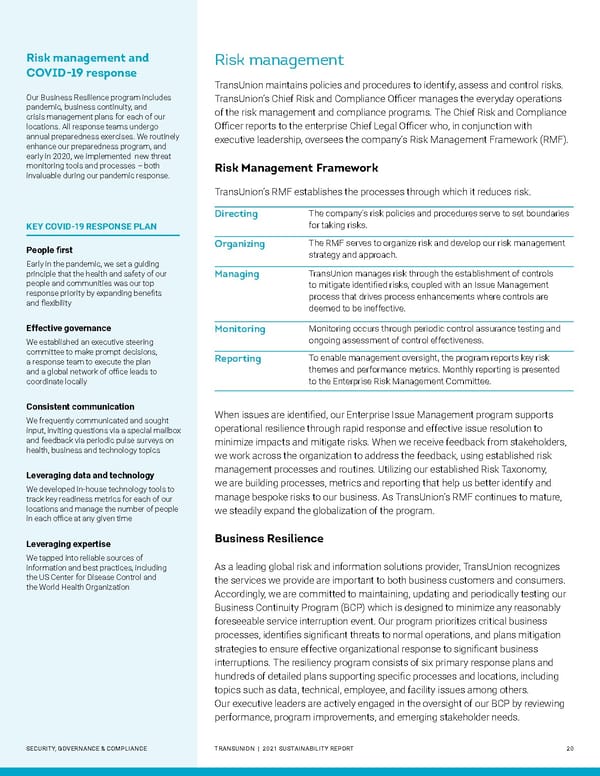

Risk management and Risk management COVID-19 response TransUnion maintains policies and procedures to identify, assess and control risks. Our Business Resilience program includes TransUnion’s Chief Risk and Compliance Officer manages the everyday operations pandemic, business continuity, and of the risk management and compliance programs. The Chief Risk and Compliance crisis management plans for each of our locations. All response teams undergo Officer reports to the enterprise Chief Legal Officer who, in conjunction with annual preparedness exercises. We routinely executive leadership, oversees the company’s Risk Management Framework (RMF). enhance our preparedness program, and early in 2020, we implemented new threat monitoring tools and processes – both Risk Management Framework invaluable during our pandemic response. TransUnion’s RMF establishes the processes through which it reduces risk. Directing The company’s risk policies and procedures serve to set boundaries KEY COVID-19 RESPONSE PLAN for taking risks. People first Organizing The RMF serves to organize risk and develop our risk management strategy and approach. Early in the pandemic, we set a guiding principle that the health and safety of our Managing TransUnion manages risk through the establishment of controls people and communities was our top to mitigate identified risks, coupled with an Issue Management response priority by expanding benefits process that drives process enhancements where controls are and flexibility deemed to be ineffective. Effective governance Monitoring Monitoring occurs through periodic control assurance testing and We established an executive steering ongoing assessment of control effectiveness. committee to make prompt decisions, Reporting To enable management oversight, the program reports key risk a response team to execute the plan themes and performance metrics. Monthly reporting is presented and a global network of office leads to coordinate locally to the Enterprise Risk Management Committee. Consistent communication When issues are identified, our Enterprise Issue Management program supports We frequently communicated and sought operational resilience through rapid response and effective issue resolution to input, inviting questions via a special mailbox and feedback via periodic pulse surveys on minimize impacts and mitigate risks. When we receive feedback from stakeholders, health, business and technology topics we work across the organization to address the feedback, using established risk Leveraging data and technology management processes and routines. Utilizing our established Risk Taxonomy, We developed in-house technology tools to we are building processes, metrics and reporting that help us better identify and track key readiness metrics for each of our manage bespoke risks to our business. As TransUnion’s RMF continues to mature, locations and manage the number of people we steadily expand the globalization of the program. in each office at any given time Leveraging expertise Business Resilience We tapped into reliable sources of As a leading global risk and information solutions provider, TransUnion recognizes information and best practices, including the US Center for Disease Control and the services we provide are important to both business customers and consumers. the World Health Organization Accordingly, we are committed to maintaining, updating and periodically testing our Business Continuity Program (BCP) which is designed to minimize any reasonably foreseeable service interruption event. Our program prioritizes critical business processes, identifies significant threats to normal operations, and plans mitigation strategies to ensure effective organizational response to significant business interruptions. The resiliency program consists of six primary response plans and hundreds of detailed plans supporting specific processes and locations, including topics such as data, technical, employee, and facility issues among others. Our executive leaders are actively engaged in the oversight of our BCP by reviewing performance, program improvements, and emerging stakeholder needs. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 20

Risk review and escalation Our Enterprise Risk Management Committee (ERMC) sets TransUnion’s risk strategy and helps prioritize risk management activities across the company. The ERMC meets on a monthly basis to facilitate continuous improvement of TransUnion’s risk management capabilities. The ERMC monitors TransUnion’s risk and governs the policies and processes related to risk, including: → Reviews the broader risk environment and provides direction to mitigate, to an acceptable level, identified risks that may adversely affect our ability to achieve our strategic objectives → Annual review of our Global Risk Taxonomy which names, classifies and defines the risks we are exposed to across the enterprise → Reviews and approves our Enterprise Risk Management Policy and additional enterprise policies in risk-related areas, such as privacy and cybersecurity The ERMC is comprised of our Chief Executive Officer and all his direct reports, as well as the Chief Information Security Officer (CISO). Material issues raised at the ERMC are escalated to the Audit and Compliance Committee and/or the Technology, Privacy and Cybersecurity Committee of the Board (TPCC) of Directors. Board of Directors Board Level Executive Mergers and Audit & Technology, Privacy Nominating & Compensation Committee Committee Acquisitions Compliance & Cybersecurity Corporate Governance Committee Committee Committee Committee Executive Enterprise Risk Management Committee Committee (ERMC) Management Business Unit Risk Privacy Office Third-Party Risk Operational Risk Working Groups & Compliance Management Committee SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 21

Cybersecurity and privacy risk management Ensuring our data is safe and properly stewarded is vital to keeping consumers protected and maintaining their trust. TransUnion maintains a dedicated TPCC as part of its Board of Directors. The TPCC assesses our risks to TransUnion’s technology and innovation strategy and approach, and monitors performance against its technology functionality and availability goals. The directors who serve in the TPCC collectively bring a wealth of experience to the Committee as data industry leaders, as well as experts in the policymaking and regulatory process. Our CISO and Chief Privacy Officer (CPO) maintain strategies and programs designed to protect consumers and data assets, align with consumer expectations, and comply with all applicable laws. The CISO and CPO have direct reporting lines to the TPCC and both report to the TPCC at every Committee meeting. Information security The security and protection of consumer information is the highest priority for TransUnion. We proactively manage our information security and cybersecurity programs, and continuously invest in improvements necessary to secure the data we hold on behalf of consumers. Our Global Information Security Department is responsible for developing, implementing and maintaining a comprehensive information security program consistent with TransUnion’s size and complexity. We employ multiple, overlapping layers of security controls to reduce risk and eliminate single points of failure. Our program focuses on risk identification and fostering resiliency, all to protect TransUnion, our assets, customers and consumers. Cybersecurity overview The objective of TransUnion’s information security plan is to maintain reasonable safeguards to: → Ensure the security and confidentiality of non-public personal information that TransUnion receives and is obligated to maintain in confidence → Protect against anticipated threats or hazards to the security or integrity of such non-public personal information → Protect against unauthorized access or use of such non-public personal information that could result in substantial harm or inconvenience to any consumer SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 22

Information security features TransUnion’s Information Security program is aligned with industry best practices. The features of our program include: Restricted data access according to job role and business unit Federal and state-level background checks Security awareness training for new hires and annual security awareness programs for all associates Annual attestation for security policies and agreements Standards for security controls, such as length of passwords, password change frequency Combination of key card and biometric access to sensitive areas Secured data centers with restricted access Annual penetration tests for both our external and internal networks, and customer-facing applications Encryption and firewall strategies for internet applications Dynamic and static code reviews System wide Data Loss Prevention (DLP) program Intrusion Detection Systems (IDS) and Intrusion Prevention Systems (IPS) *On an annual basis, TransUnion engages a trusted business partner (PricewaterhouseCoopers LLP) to conduct the annual review work required for the SOC 2 Type 2 Report. The scope of the report includes TransUnion’s systems relevant to our Data Centers and key applications used by our customers. The review itself is based on the criteria set forth in paragraph 1.26 of the AICPA Guide for Reporting on Controls at a Service Organization relevant to Security and Availability. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 23

Information security certifications and validation TransUnion is committed to aligning with industry-leading, cyber risk management best practices, and complying with all legal and regulatory requirements. Our information security program is fundamentally based on ISO\IEC 27001:2013; it includes a global-level Information Security Department that develops the company’s security policies, standards and procedures. This department centrally administers security on the major corporate platforms, and oversees the administration of other systems and platforms. TransUnion maintains several information security certifications annually, including Payment Card Industry (PCI), SSAE 18 SOC II Type II and ISO 27001. To maintain certifications and align with best practices, we conduct regular cybersecurity-related audits and assessments both internally and externally. Our internal and external independent security audits and assessments are conducted at least annually. TU’s Business ISO 27001 PCI SSAE 18 SOC 2 Type 2 India Planned for 2022 United States Canada Brazil Ireland United Kingdom Hong Kong Planned for 2022 Planned for 2022 South Africa Planned for 2022 Philippines The types of certifications we maintain in a region are specific to the products and services we offer in that geography. We maintain ISO 27001 certifications for our operations in TransUnion- Leeds, UK; TransUnion CIBIL- Mumbai, India and TransUnion- Sao Paulo, Brazil. Our TransUnion Consumer Interactive (TUCI) US business also maintains PCI and SSAE 18 SOC 2 Type 2 certifications. Additionally, TransUnion conducts NIST Cybersecurity Framework assessments to continually monitor our practices. Our governance, risk and compliance programs align their methodologies with the risk management hierarchy defined in NIST SP 800-39 in order to facilitate uniform communication, reporting and treatment of information technology risks. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 24

Cyber threat and intelligence Our Cyber Threat and Intelligence function tracks and classifies potential information security-related events. Within our 24/7/365 Security Operations Center, TransUnion associates monitor for any attempts to access our systems or data. We deploy industry-leading security solutions to manage the vulnerability and threat environment affecting our businesses across the globe. Internal and external vulnerability management solutions are used to monitor our networks, including our connections with customers and partners. Our applications and networks undergo internal and external, third-party penetration tests on an annual basis — or more frequently contingent on the threat environment. TransUnion participates in the Financial Information Sharing and Analysis Council (“FS-ISAC”) where companies — including other US nationwide consumer credit reporting companies — share information regarding cyber threats, attacks and solutions to understand the evolving threat environment. We regularly test, update and revise our incident response plans based on the behavior of threat actors attempting to access our computer systems, software, networks, data and other technology assets on a daily basis. Physical and personal security Physical security is a crucial component of information security and worker safety. In our most sensitive sites, TransUnion employs stringent physical security controls limiting access to our facilities, including biometric and badge access, and security guards at external entry points. In addition, we employ automated mechanisms to recognize potential intrusions and initiate designated response actions. Through the Corporate Security Program, TransUnion continuously assesses security risks confronting our global assets, products and people, and works to reduce the security risks to which we are exposed. At the same time, we guard against complacency and enable each employee to first and foremost contribute to their own security. Through this work, we develop and maintain a culture that is recognized globally as one that prioritizes security as a business value and is unwilling to compromise on the safety and security of our employees and the data we steward. Third-party risk management We regularly work with third-party vendors, suppliers and partners. Our Third-Party Risk Management (“TPRM”) program sets forth requirements and guidelines for the third parties with whom we do business. As part of our TPRM program, TransUnion uses an Enterprise Security Ratings Platform which gathers terabytes of data from security sensors around the world, and provides insights concerning potential risks emanating from infected machines, improper configuration, poor security hygiene and harmful user behavior. Each third-party company receives a security rating based on the severity, frequency and duration of security incidents. When third parties do not meet our standards, we terminate our relationship with them and look for new partners that meet our security and stewardship requirements. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 25

Data privacy Responsible data stewardship is fundamental to our mission. We have developed, and continue to augment, a comprehensive, global program to protect consumer information and our data assets. Our program is built upon TransUnion’s Global Privacy Policy which requires compliance across the enterprise, including all of TransUnion’s business units, and direct and indirect majority-owned company subsidiaries. Collectively, these efforts ensure all new products and services comply with the most current privacy regulations around the world and meet or exceed consumers’ evolving privacy expectations. To ensure compliance with privacy standards and expectations, all associates are required to complete annual privacy trainings that cover applicable privacy regulations, including but not limited to the California Consumer Privacy Act and General Data Protection Regulation. Additional detail is included in the Associate Training Appendix. TransUnion regularly conducts privacy-focused assessments of our products, and processing activities for compliance with privacy regulations and alignment with consumer expectations. Our assessments consider the nature of the data use, transparency of the use and the notice made available to consumers, along with information security, individuals’ legal rights and expectations, and any relevant data quality considerations. TransUnion works extensively across industry and trade groups, as well as with regulators and customers, in an effort to ensure a high level of product compliance with privacy standards. We also incorporate the views of individuals via consumer research. TransUnion has a thorough diligence process for mergers, acquisitions and investments, and considers information security and privacy risk when evaluating every potential transaction. We review a potential acquisition’s privacy program maturity and its compliance with privacy regulations on a global basis, in addition to looking at the fairness and transparency of its data use and how those uses benefit individuals. SECURITY, GOVERNANCE & COMPLIANCE TRANSUNION | 2021 SUSTAINABILITY REPORT 26

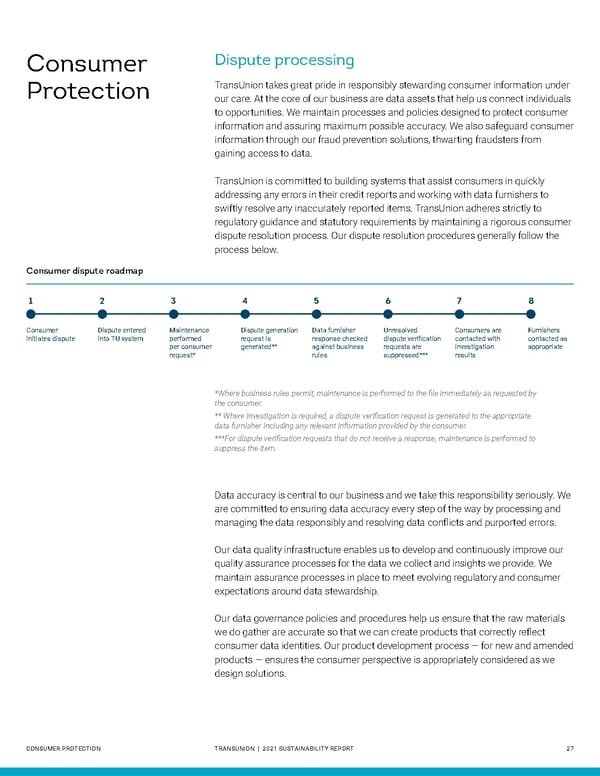

Consumer Dispute processing Protection TransUnion takes great pride in responsibly stewarding consumer information under our care. At the core of our business are data assets that help us connect individuals to opportunities. We maintain processes and policies designed to protect consumer information and assuring maximum possible accuracy. We also safeguard consumer information through our fraud prevention solutions, thwarting fraudsters from gaining access to data. TransUnion is committed to building systems that assist consumers in quickly addressing any errors in their credit reports and working with data furnishers to swiftly resolve any inaccurately reported items. TransUnion adheres strictly to regulatory guidance and statutory requirements by maintaining a rigorous consumer dispute resolution process. Our dispute resolution procedures generally follow the process below. Consumer dispute roadmap 1 2 3 4 5 6 7 8 Consumer Dispute entered Maintenance Dispute generation Data furnisher Unresolved Consumers are Furnishers initiates dispute into TU system performed request is response checked dispute verification contacted with contacted as per consumer generated** against business requests are investigation appropriate request* rules suppressed*** results *Where business rules permit, maintenance is performed to the file immediately as requested by the consumer. ** Where investigation is required, a dispute verification request is generated to the appropriate data furnisher including any relevant information provided by the consumer. ***For dispute verification requests that do not receive a response, maintenance is performed to suppress the item. Data accuracy is central to our business and we take this responsibility seriously. We are committed to ensuring data accuracy every step of the way by processing and managing the data responsibly and resolving data conflicts and purported errors. Our data quality infrastructure enables us to develop and continuously improve our quality assurance processes for the data we collect and insights we provide. We maintain assurance processes in place to meet evolving regulatory and consumer expectations around data stewardship. Our data governance policies and procedures help us ensure that the raw materials we do gather are accurate so that we can create products that correctly reflect consumer data identities. Our product development process — for new and amended products — ensures the consumer perspective is appropriately considered as we design solutions. CONSUMER PROTECTION TRANSUNION | 2021 SUSTAINABILITY REPORT 27

Fraud prevention Fraud is increasing in volume and sophistication and TransUnion is enhancing its fraud prevention capabilities in response. We developed a suite of solutions called TM TruValidate to help companies better identify and prevent fraud, quickly verify a consumer’s identity to secure trust across channels, and reduce friction in the loan origination or credit application process. This helps consumers keep their financial history and status intact, and enables companies to mitigate losses while expanding business opportunities. TruValidate is an integrated suite of digital identity proofing, risk-based authentication and fraud analytics solutions that works to learn and predict patterns of risk to help customers anticipate threats by staying ahead of fraudsters. In confirming identity throughout the customer lifecycle, TruValidate solutions help improve operational effectiveness by reducing manual reviews, automating systems and proactively identifying potential fraud. TruValidate solutions also enable companies to verify and authenticate the identity of new-to-credit consumers while better preventing fraud abuses, such as synthetic identity fraud, first-party fraud or loan stacking. CONSUMER PROTECTION TRANSUNION | 2021 SUSTAINABILITY REPORT 28

People People overview and DEI Our passionate, highly trained associates bring their experiences, perspectives and creativity to our teams around the world. Behind TransUnion’s information and insights are knowledgeable and dedicated associates in dozens of countries — numbering more than 10,000 with our acquisitions of Neustar and Sontiq. Employee well-being remained front and center in 2021 as we navigated the uncertainties related to the COVID-19 pandemic, talent competition, reimagining work, and global calls for equity. In the section that follows, we describe the programs and resources we made available to our employees during the year, ensuring they felt heard and supported — and remained connected during difficult times. TransUnion’s culture is truly one of our strongest assets. We value our employees’ health and well-being, as well as a collaborative and open work culture. We support our associates by providing competitive benefits, meaningful work, and programs that enable all our people to develop and enhance their skills. We also placed our associates’ well-being first by providing mental health benefits to them and their families around the world, and by creating multiple global wellness days so associates could spend down-time with their family and friends. As we continued remote work for the second year, we looked for new ways to connect associates — from virtual onboarding to everyday virtual activities, including fitness classes and meditations, recipe contests, talent competitions, coffee and conversation events, and DJ-led online music sessions. Our culture and care for one another has carried us through this unique and often trying experience. PEOPLE AND DEI TRANSUNION | 2021 SUSTAINABILITY REPORT 29

Diversity, equity and inclusion At TransUnion, we believe our collective differences make us stronger, more innovative, empathetic and successful. At a time when social and racial issues remain firmly at the global forefront, we stand united and committed to helping create a truly equitable environment for all. In 2021, TransUnion took a number of important actions to support the inclusion and advancement of all people. Together, we: 1 Advanced efforts supporting our CEO Action for Diversity & Inclusion pledge. Through the CEO Action for Racial Equity Fellowship, we helped advance public policies and corporate engagement strategies addressing systemic racism and social injustice — working across the TU network to collaborate on work with Government Relations, Corporate Affairs, Marketing and other key teams. 2 Continued CEO listening sessions, as well as associate-led conversations on race — which included members of executive leadership. Executive leaders also hosted town halls where they covered diversity topics with their global teams. 3 Expanded our unconscious bias training to include all levels of associates. Training sessions focused on concepts of unconscious bias and included two levels of engagement — first through an immersive desktop virtual reality experience, and then through small group breakout discussions where we held meaningful conversations on race, gender and other differences. 4 Launched our Women in Leadership program which invites high-potential women directors and managers to participate in a year-long career development program as part of our commitment to gender equity. 5 Partnered with McKinsey & Co. in offering the Black Leadership Academy to Black associates, providing them the opportunity to network and develop their skills and leadership experience. 6 Offered a number of programs, including flexible work arrangements, paid parental leave and numerous other benefits that enabled parents to continue to further their careers while meeting the demands of their personal lives. 7 Supported gender equity through amicus briefs of pending court decisions. For additional detail regarding our Diversity, Equity & Inclusion efforts, please explore our 2021 Diversity Report. PEOPLE AND DEI TRANSUNION | 2021 SUSTAINABILITY REPORT 30

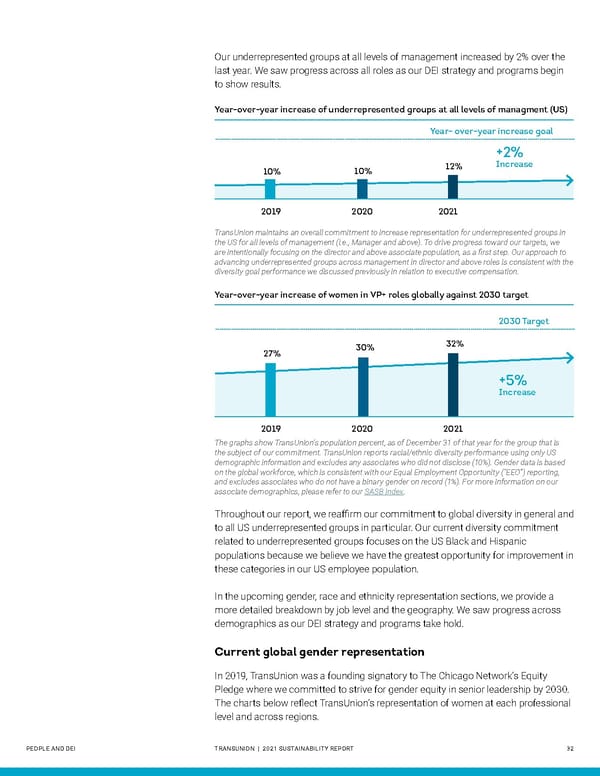

Global diversity strategy We have a three-pronged approach to our diversity, equity and inclusion strategy consisting of the following: Hire: We seek to expand the diversity of our talent pool through a dedicated diversity recruiter, targeted sourcing methods and job postings. Develop: We cultivate diverse talent internally through development plans and customized programming for underrepresented groups. Promote: We continue to expand our rigorous pay and promotion practices designed to remove bias, including ongoing pay equity analysis and compensation review, and development opportunities designed to ensure fair and equitable treatment of all employees. In the United States, TransUnion is focusing its inclusion efforts on the Black and Hispanic communities as they comprise some of the largest representation gaps in our enterprise. We engaged more diverse talent by enhancing our diversity recruitment efforts and targeted sourcing methods — which included providing clear definitions on what constitutes a diverse slate of candidates and increasing consideration of non-traditional candidate profiles. In 2021, TransUnion participated in 12 diversity-focused recruiting events and workshops in the US, and we look forward to continued engagement and growth in coming years. We maintain tailored engagements to address the specific needs and opportunities that exist for each underrepresented group, including relationships with select Historically Black Colleges and Universities (HBCUs) and Hispanic-Serving Institutions (HSIs). Internationally, we are working to develop diversity programming that is consistent with our corporate equity goals while being conscious of cultural differences. Regions maintain programming to help support our gender parity efforts through regional mentorship, networking and development programs, as appropriate. Offices like Brazil and South Africa stand out for their LGBTQ+ efforts by creating trans-inclusive trainings and launching new PRIDE employee group chapters, respectively. Measuring progress We continue our efforts to create a more inclusive workplace every year. To hold ourselves accountable, we assess our progress against our commitments to gender equity and equity amongst underrepresented groups. The graphs below show TransUnion’s equity progress from 2019 to 2021 at the management and leadership levels. From 2019 to 2021, we saw a 2% increase of underrepresented groups in management in the United States, while women’s representation in leadership increased by 5% globally during the same period. PEOPLE AND DEI TRANSUNION | 2021 SUSTAINABILITY REPORT 31

Our underrepresented groups at all levels of management increased by 2% over the last year. We saw progress across all roles as our DEI strategy and programs begin to show results. Year-over-year increase of underrepresented groups at all levels of managment (US) Year- over-year increase goal +2% 10% 10% 12% Increase 2019 2020 2021 TransUnion maintains an overall commitment to increase representation for underrepresented groups in the US for all levels of management (i.e., Manager and above). To drive progress toward our targets, we are intentionally focusing on the director and above associate population, as a first step. Our approach to advancing underrepresented groups across management in director and above roles is consistent with the diversity goal performance we discussed previously in relation to executive compensation. Year-over-year increase of women in VP+ roles globally against 2030 target 2030 Target 30% 32% 27% +5% Increase 2019 2020 2021 The graphs show TransUnion’s population percent, as of December 31 of that year for the group that is the subject of our commitment. TransUnion reports racial/ethnic diversity performance using only US demographic information and excludes any associates who did not disclose (10%). Gender data is based on the global workforce, which is consistent with our Equal Employment Opportunity (“EEO”) reporting, and excludes associates who do not have a binary gender on record (1%). For more information on our associate demographics, please refer to our SASB index. Throughout our report, we reaffirm our commitment to global diversity in general and to all US underrepresented groups in particular. Our current diversity commitment related to underrepresented groups focuses on the US Black and Hispanic populations because we believe we have the greatest opportunity for improvement in these categories in our US employee population. In the upcoming gender, race and ethnicity representation sections, we provide a more detailed breakdown by job level and the geography. We saw progress across demographics as our DEI strategy and programs take hold. Current global gender representation In 2019, TransUnion was a founding signatory to The Chicago Network’s Equity Pledge where we committed to strive for gender equity in senior leadership by 2030. The charts below reflect TransUnion’s representation of women at each professional level and across regions. PEOPLE AND DEI TRANSUNION | 2021 SUSTAINABILITY REPORT 32

We continue to see progress within leadership as we march toward more equitable representation in our senior-most roles. The flexible work arrangements, development opportunities and network of Women @ TU chapters provide strong support to our female workforce. During 2020 and 2021, we saw a small dip in female directors. In 2021, we launched a global leadership mentorship program for high-performance women to network and develop their skills. GLOBAL REPRESENTATION OF WOMEN* BY LEVEL 2019 2020 2021 Senior leaders** % % % 27 30 32 Directors % % % 34 33 32 Managers % % % 36 35 35 Admin. and professionals % % % 44 43 43 *In 2021, TransUnion introduced the option for associates to identify as non-binary for US associates. The number of associates who chose to identify as non-binary is not reflected in the gender representation numbers reported herein. **We define our “senior leaders” as VP and above roles; “directors” encompass Director, Sr. Director, Principal, Sr. Principal and Sales VP level roles; “managers” are defined as Manager, Sr. Manager, Sales Manager, Advisor and Sr. Advisor level roles; and “admin and professionals” make up the rest of our associate population. GLOBAL REPRESENTATION OF WOMEN BY REGION 2019 2020 2021 Africa 54% 54% 60% Asia Pacific % % % 45 48 47 Brazil % % % 40 40 44 Canda % % % 51 49 46 Europe % % % 37 38 37 India % % % 28 28 31 LATAM % % % 48 47 44 United States 42% 42% 41% * In 2021, TransUnion introduced the option for associates to self-identify as non-binary for US associates. The number of associates who chose to identify as non-binary is not reflected in the gender representation numbers reported herein. TransUnion’s global gender representation varies by region. In Africa, Brazil and India, TransUnion has shown increases leading in our gender representation growth, while places like the United States, Europe and the Middle East remained stable. Conversely, we saw opportunities to improve in Canada and Asia Pacific. Our commitment to workplace excellence and inclusion has been recognized by the Great Places to Work Institute, across various regions including, India, Colombia and the United States. We have plans to help support our female employees and enterprise targets for each region while remaining cognizant of cultural differences in the many places where we operate. PEOPLE AND DEI TRANSUNION | 2021 SUSTAINABILITY REPORT 33

Current US race and ethnicity representation Our diversity demographics reporting is consistent with EEO guidelines and limits our race and ethnicity disclosure to the United States. We are committed to striving for year-over-year increase of underrepresented groups at all levels of management. The chart below illustrates our progress across all underrepresented groups by level. We recognize work remains to continue to create opportunities across all levels of management. UNDERREPRESENTED GROUP BY LEVEL 2019 2020 2021 Senior leaders % % % 9 9 11 Directors % % % 8 10 12 Managers 11% 11% 11% Admin. and professionals % % % 21 21 22 We define our “senior leaders” as VP and above roles; “directors” encompass Director, Sr. Director, Principal, Sr. Principal and Sales VP level roles; “managers” are defined as Manager, Sr. Manager, Sales Manager, Advisor and Sr. Advisor level roles; and “admin & professionals” make up the rest of our associate population. Below is a percentage breakdown of our 2021 US workforce by role and corresponding race/ethnicity demographics. What we looked like in 2021 Admin & Professionals 54% 22% 10% 12% 2% Managers 68% 18% 5% 6% 2% Directors 68% 18% 7% 5% 2% Senior Leaders 75% 12% 7% 5% 1% White Asian Hispanic Black Other We define our “senior leaders” as VP and above roles; “directors” encompass Director, Sr. Director, Principal, Sr. Principal and Sales VP level roles; “managers” are defined as Manager, Sr. Manager, Sales Manager, Advisor and Sr. Advisor level roles; and “admin & professionals” make up the rest of our associate population. The race/ethnicity diversity data only includes associates located in the United States, who self-identified. ‘Other’ encompasses the following associate demographics: American Indian or Alaska Native, Native Hawaiian or Other Pacific Islanders, and Two or More Races. PEOPLE AND DEI TRANSUNION | 2021 SUSTAINABILITY REPORT 34