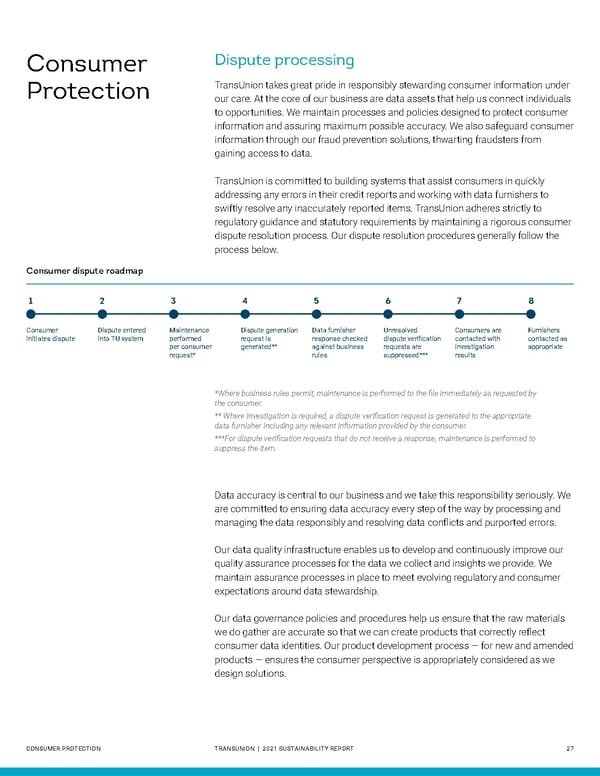

Consumer Dispute processing Protection TransUnion takes great pride in responsibly stewarding consumer information under our care. At the core of our business are data assets that help us connect individuals to opportunities. We maintain processes and policies designed to protect consumer information and assuring maximum possible accuracy. We also safeguard consumer information through our fraud prevention solutions, thwarting fraudsters from gaining access to data. TransUnion is committed to building systems that assist consumers in quickly addressing any errors in their credit reports and working with data furnishers to swiftly resolve any inaccurately reported items. TransUnion adheres strictly to regulatory guidance and statutory requirements by maintaining a rigorous consumer dispute resolution process. Our dispute resolution procedures generally follow the process below. Consumer dispute roadmap 1 2 3 4 5 6 7 8 Consumer Dispute entered Maintenance Dispute generation Data furnisher Unresolved Consumers are Furnishers initiates dispute into TU system performed request is response checked dispute verification contacted with contacted as per consumer generated** against business requests are investigation appropriate request* rules suppressed*** results *Where business rules permit, maintenance is performed to the file immediately as requested by the consumer. ** Where investigation is required, a dispute verification request is generated to the appropriate data furnisher including any relevant information provided by the consumer. ***For dispute verification requests that do not receive a response, maintenance is performed to suppress the item. Data accuracy is central to our business and we take this responsibility seriously. We are committed to ensuring data accuracy every step of the way by processing and managing the data responsibly and resolving data conflicts and purported errors. Our data quality infrastructure enables us to develop and continuously improve our quality assurance processes for the data we collect and insights we provide. We maintain assurance processes in place to meet evolving regulatory and consumer expectations around data stewardship. Our data governance policies and procedures help us ensure that the raw materials we do gather are accurate so that we can create products that correctly reflect consumer data identities. Our product development process — for new and amended products — ensures the consumer perspective is appropriately considered as we design solutions. CONSUMER PROTECTION TRANSUNION | 2021 SUSTAINABILITY REPORT 27

Sustainability Report | TransUnion Flipbook Page 26 Page 28

Sustainability Report | TransUnion Flipbook Page 26 Page 28